You might be asking, Who Pays Closing Costs in Florida if you are considering buying or selling real estate. If this is the case, then you will want to review this article in its entirety.

My name is Steve Daria and I have been a real estate agent since 2002, a real estate broker and owner of a midsize real estate firm since 2006 (selling it in 2018) and a real estate investor since 2003.

Needless to say, I have been part of literally thousands of Florida Real Estate Transactions.

So, Who Pays Closing Costs in Florida? Short answer, it depends.

What are the Closing Costs in Florida?

Before we jump into Who Pays Closing Costs in Florida, it is important to know all the closing costs associated with a real estate transaction in the state of Florida.

By the end of this article you will not only know Who Pays Closing Costs in Florida but you also will have a deep understanding of each line item on a HUD / Settlement Statement along with a sample so you can easily see who is paying what in a real estate sale.

I am going to provide a sample of an actual closing of a house we purchased in Cape Coral Florida where we paid all the closing costs. But not the liens…

Liens vs Closing Costs in Florida

When you’re selling a house or real estate in Florida, there are two important things to understand when figuring your bottom line which are liens and closing costs. These might sound like big words, but let’s break them down!

Liens: What Are They?

Think of a lien like a promise or a guarantee. When someone buys a house using a loan (money borrowed from the bank), the bank puts a lien on the house. It’s like saying, “Hey, until you pay back all the money you borrowed, this house belongs to us too!”

However, as you will see later on this article, liens can also be related to contractors. Let’s say you added Solar Panels to your house and took a loan, that contractor or bank will lien that property for the duration of the term (IE – 10 years).

City liens are another common encumbrance against the property. Let’s say a homeowner had a bunch of overgrown grass and weeds and were fined $25 per day and it added up to $7,500 over time, that lien will need to be paid (or satisfied) at closing.

And assessments. Sometimes an HOA can lien a property as they do not have enough reserve funds for a certain project and every house or condo gets assessed. Sometimes, certain areas will have city water or sewer will be installed at the expense of the homeowner.

Now in many cases, these liens are the responsibility of the seller at closing. Where the funds will come out of the seller’s proceeds at closing.

For example, let’s say a buyer is paying $100,000 and all the closing costs. And a seller owes $30,000 to a bank for a mortgage and $5,000 to a contractor for a fence that was built. At closing the title company will pay (from the proceeds), the bank and the contractor, leaving the seller with?? You guessed right! $65,000 ($100k – $30k – $5k = $65k).

PS – If you are getting value from this article, please share with others who might benefit from it. Thank you : ) Ok, moving on…

Closing Costs: What Are They?

Closing costs are like the extra bills you have to pay when buying or selling a house. So, Who Pays Closing Costs in Florida? Well short answer, they are negotiable.

They cover things like paperwork, taxes, insurances and fees for services. Usually, when you sell a house in Florida, you might have to pay some or all of these costs.

So, let’s talk about Closing Costs in Florida, one by one…

Closing Costs in Florida

When negotiating Who Pays Closing Costs in Florida, it is really important to understand what each of these fees are and roughly the cost of them.

The video here to the right will provide more insight as well.

But, first, let’s start with the Tax Man…

There are really 3 types of Taxes in a real estate closing in Florida.

- Doc Stamps on the Deed

- Doc Stamps on the Mortgage (Loans)

- Real Estate Tax Prorations

Doc Stamps on The Deed in Florida

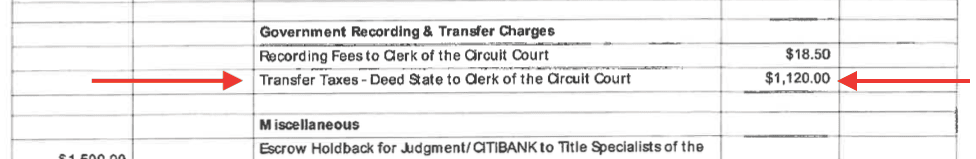

When you transfer real estate ownership, you usually have to pay a tax based on the price. The standard tax rate is $0.70 for every $100 of the total price. So for example, if you sold a house for $300,000 someone is responsible for paying $2,100 ($300,000 / $100 = $3,000 X .70 = $2,100).

So, when you are asking Who Pays Closing Costs in Florida pertaining to Doc Stamps on the Deed, usually it is the seller. Below you will see the sample on a real closing statement so you know what to look for.

Keep in mind that every settlement statement can be labeled a little differently depending on the closing agent (Title Company or Attorney).

Here are some examples of documents that might involve transferring real estate ownership:

- Warranty deeds

- Quit claim deeds

- Contracts for things like timber, gas, oil, or mineral rights

- Easements (rights to use someone else’s property)

- Contracts or agreements for deed

- Assignments of contracts or agreements for deed

- Assignments of leasehold interest (transferring a lease)

- Assignments of beneficial interest in a trust

- Deeds instead of going through with a foreclosure

Doc Stamps on the Mortgage in Florida

When a purchaser obtains a mortgage, seller financing or any kind of loan documented in Florida, you have to pay the mortgage documentary stamp tax. This tax is like a fee for having your paperwork filed or recorded. The rate for this tax is $0.35 for every $100 of the loan amount.

So, if you borrow paid $300,000 for that example above and you put down $50,000, you will have mortgage of $250,000. Remember, this is on the mortgage (loan) amount only. Here’s how the math looks. $250,000 / $100 = $2,500 X .35 = $875.

Who Pays Closing Costs in Florida regarding the Doc Stamps on the mortgage? Well, usually the buyer. However, this is getting a little off-subject; sometimes, we will see offers written where they will provide “a credit of 3% toward the buyer’s prepaid / and or closing costs.”

In this case, the seller is kind of paying for it. We usually see this when someone struggles to come up with the down payment and closing costs.

Real Estate Tax Prorations

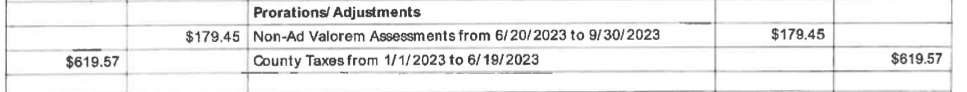

In Florida, real estate tax prorations at closing are a common aspect of property transactions. When a property is sold, the seller has typically paid property taxes for the entire year up to the date of closing. However, since the buyer will own the property for part of the year, it’s fair for them to contribute their portion of the property taxes for that period.

Prorating property taxes involves dividing the annual property tax amount by the number of days in the year and then multiplying that daily rate by the number of days each party will own the property during that year. At closing, the seller will credit the buyer for the portion of property taxes they’ve already paid but won’t owe because they’re no longer the owner. Conversely, the buyer will reimburse the seller for the portion of property taxes owed for the time they’ll own the property during that tax year.

In the screen shot below you will find two prorations of taxes that took place. In the Non-Ad Valorem, was a credit to the seller (prepaid) and a debit to the buyer. On the flip side, the County taxes were a credit to the buyer as the seller didn’t pay them. You will be able to see this more detailed in the PDF I provided below.

You might be asking when it comes to these promotions, Who Pays Closing Costs in Florida? Typically, these prorations are calculated by the closing agent or attorney handling the transaction, and the details are outlined in the closing documents such as below. These are usually not part of a negotiated line item as you could almost consider it a paid or unpaid lien.

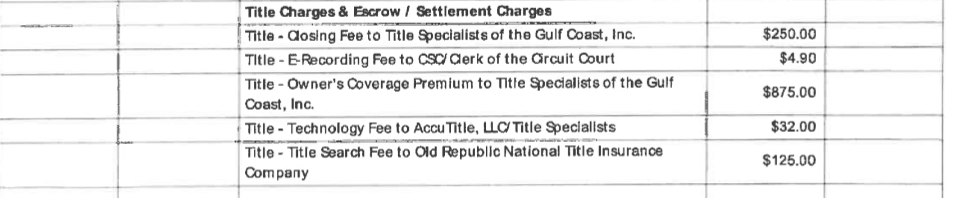

Who Pays Closing Costs in Florida Regarding Title Insurance & Fees?

As you can see in the screenshot below, the title fees can add up quickly. Now, there are really only two types of closing agents in Florida. You have Title Companies and Attorneys. Whoever is negotiated to pay these fees usually chooses who they will use.

Many times, title companies charge less in their fees than a Florida real estate attorney.

As you can see here, there are title fees, recording fees, title search fees, technology fees and title insurance. Title insurance fluctuates with the price of the property. We should briefly talk about what exactly title insurance is before moving on.

What is Florida Title Insurance?

Title insurance in Florida is a crucial component of real estate transactions, designed to protect both buyers and lenders from potential issues related to the property’s title. Essentially, title insurance ensures that the title to a piece of real estate is legitimate and free from any defects or encumbrances that could jeopardize the owner’s or lender’s rights to the property.

In Florida, like in many other states, there are two types of title insurance policies: owner’s title insurance and lender’s title insurance. Owner’s title insurance is typically purchased by the buyer and provides protection against any defects in the title that may arise after the property is purchased. This can include issues such as undisclosed liens, errors or omissions in public records, forgery, or fraud. Lender’s title insurance, on the other hand, is usually required by the mortgage lender to protect their investment in the property. It ensures that the lender has a valid lien on the property and priority over any other claims or liens.

The process of obtaining title insurance in Florida involves a thorough examination of the property’s title history to uncover any potential issues or risks. This examination is typically conducted by a title company or attorney who specializes in real estate law. Once any issues are identified and resolved, a title insurance policy is issued to the buyer and/or lender, providing them with peace of mind and financial protection if a title defect is discovered in the future. And they can then proceed to closing.

Real Estate Closing Cost Calculator

Below you will find a simple closing cost calculator to get a rough idea of what title insurance costs as well as Doc Stamps On The Deed. These two costs are usually the heaviest costs in a Florida real estate transaction outside of mortgage-related closing costs.

Real Estate Closing Calculator

This is merely an estimate of closing costs if you are paying for Doc Stamps on the Deed and Title Insurance. This doesn’t include other title fees, recording fees, mortgage-related costs or prorations.

Before moving on, I would like to make you aware that when we buy real estate in Florida, we pay all the closing costs!! You can fill out your info below and I will personally call you to talk more in detail!

Get An Offer Today, Sell In A Matter Of Days…

Real Estate Commissions in Florida

Traditionally if a seller goes to open market, they will list with a REALTOR on MLS. These commissions are always negotiable between the listing agent and seller. In most cases, the seller is responsible for paying these commissions.

This is a reason why many Florida property sellers reach out to us to buy their property. For example. Let’s say you listed and sold your $350,000 house at 7% commission, you’d be obligated to pay $24,500.

Real Estate Attorney Fees in Florida

If you, as a buyer or seller, wish to retain an attorney to oversee a real estate closing, you can expect to pay for their expertise and guidance. Whoever is the one who retained (hired) them would be responsible for their fees if you are figuring out Who Pays Closing Costs in Florida.

Other Closing Costs in Florida

In the Settlement Statement Below, you will find a cash closing from our holding company (CRES HOLDINGS) where we bought this property in less than 3 weeks.

The gentleman moved to Florida to be with his mother and she passed away. He decided he has no other reason to be living in Florida and wanted to move back up north.

As you can see from the settlement statement, financially, he had some hardship liens and other payoffs that he was responsible for. However, we paid for all the closing costs (Title, Doc Stamps, Etc).

He didn’t have a mortgage, but he did get the total amount less tax prorations and the miscellaneous liens that were filed against the property at closing.

So, if you do have random liens or judgments, you don’t have to worry about them, as the title company handles paying them all at closing on your behalf!

As promised, here is the downloadable PDF closing statement. I hope I have provided you value and don’t hesitate to reach out if you are contemplating selling your property in Florida.

Download Your FREE Stop Foreclosure Guide Below

Just put in your name and email, click “Submit” and we’ll email you the Free Guide right away.