Facing foreclosure can feel overwhelming for homeowners in Florida, particularly in Cape Coral, where the housing market has faced its share of challenges. Understanding the various foreclosure prevention measures in Cape Coral is crucial for residents looking to safeguard their homes and financial well-being. Read on as we explore practical strategies and resources available to help homeowners navigate the complexities of foreclosure and implement proactive foreclosure prevention measures in Cape Coral to secure their futures.

In foreclosure prevention, real estate investors like Steve Daria and Joleigh have made significant contributions by offering tailored solutions for struggling homeowners in Cape Coral. Their expertise not only aids residents in understanding their options but also fosters a supportive community where financial stability can be restored. By leveraging their knowledge, homeowners can explore viable alternatives to foreclosure and work towards securing a brighter future.

What is Foreclosure?

Foreclosure occurs when a homeowner has missed payments, prompting the lender to take possession of and sell the property in order to recover the outstanding amount.

It is a legal process that can have severe financial and emotional consequences.

The Impact of Foreclosure

Foreclosure can have lifetime effects on your credit score, making it difficult to get loans ahead or mortgages.

It can also lead to the loss of your home and significant stress for you and your family.

The ripple effects can be felt for years, affecting your financial stability and peace of mind.

Why Foreclosure Happens

Foreclosure can be triggered by various factors, including job loss, medical emergencies, or adjustable-rate mortgages that become unaffordable.

Recognizing the root causes can help you take proactive steps to prevent it.

Key Foreclosure Prevention Measures in Cape Coral

Explore these essential foreclosure prevention measures in Cape Coral and widen your options.

Communicate with Your Lender

One of the most effective foreclosure prevention actions in Cape Coral, Florida, is maintaining open communication with your lender.

If you’re struggling to make payments, inform your lender immediately.

Many lenders offer hardship programs or loan modifications to help you stay on track.

Understand Your Mortgage Options

Familiarize yourself with different mortgage options available in Cape Coral.

Fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans each have their pros and cons.

Choosing the right mortgage type can remarkably impact your ability to manage payments.

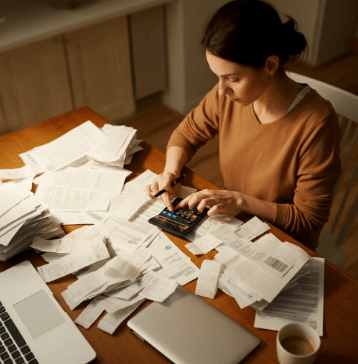

Create a Budget and Stick to It

A well-prepared budget is a powerful tool in foreclosure prevention.

Track your cash flow and expenses meticulously, and identify areas where you can cut costs.

Allocate funds specifically for mortgage payments to ensure they remain a top priority.

Get An Offer Today, Sell In A Matter Of Days…

Government Assistance Programs

Here’s how you can leverage Government Assistance Programs:

Housing Counseling Agencies

HUD-approved housing counseling agencies offer free or low-cost advice on foreclosure prevention.

These agencies can help you realize your rights, explore your options, and develop a personalized action plan.

Federal Programs

Several federal programs, such as the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP), provide assistance to homeowners facing foreclosure.

These programs offer loan modifications, refinancing options, and other forms of relief.

State and Local Initiatives

Florida offers various state and local initiatives designed to help homeowners avoid foreclosure.

The Florida Hardest-Hit Fund, for example, provides mortgage assistance to eligible homeowners experiencing financial hardship.

Loan Modification and Refinancing

One of the foreclosure prevention measures in Cape Coral is loan modification and refinancing.

Here’s how you can leverage it:

Loan Modification

This involves altering the terms of your mortgage to make it more affordable.

This could include extending the loan term, decreasing the interest rate, or changing the loan type.

Contact your lender to discuss modification options.

Refinancing

Refinancing your current mortgage can lower your monthly payments by getting a lower interest rate or extending the loan term.

However, it is necessary to consider the costs related to refinancing, such as closing fees and application costs.

Eligibility Criteria

Both loan modification and refinancing have specific eligibility criteria.

Your credit score, loan balance, and payment history will influence your eligibility.

Consulting with a mortgage consultant can help you determine the best course of action.

Short Sales and Deed-in-Lieu of Foreclosure

Here’s how you can utilize short sales and deed in lieu of foreclosure in Cape Coral:

Short Sales

A short sale occurs when you sell your home for less than the remaining mortgage balance, with the lender’s approval.

This option can prevent foreclosure and minimize credit score damage.

However, it requires the lender’s cooperation and can be a lengthy process.

Deed-in-Lieu of Foreclosure

In a deed-in-lieu of foreclosure, you voluntarily shift ownership of your property to the lender, resulting in the cancellation of your mortgage debt.

While this option still impacts your credit score, it’s generally less damaging than a foreclosure.

Pros and Cons

Both short sales and deeds-in-lieu have their advantages and disadvantages.

It’s crucial to weigh these carefully and consult with a real estate expert to identify the best option for your situation.

Bankruptcy as a Last Resort

Discover how bankruptcy can be a final option for homeowners facing foreclosure, outlining its implications and potential benefits.

Types of Bankruptcy

Bankruptcy should be contemplated as a last resort for foreclosure prevention.

Chapter 7 and Chapter 13 bankruptcy contribute temporary relief from foreclosure, but they come with significant long-term consequences.

Impact on Foreclosure

Filing for bankruptcy prompts an automatic stay, temporarily halting foreclosure proceedings.

This can give you time to reorganize your finances and explore other options.

However, bankruptcy will severely impact your credit score and remain on your credit assessment for up to ten years.

Legal Considerations

Consulting with a bankruptcy lawyer is critical to understanding the legal implications and determining if bankruptcy is the right choice for you.

They can guide you through the process.

Tips for Real Estate Investors

Explore practical tips for real estate investors to navigate the complex landscape of foreclosure prevention measures in Cape Coral and across Florida.

Identify At-Risk Properties

Real estate investors in Cape Coral can benefit from identifying properties at risk of foreclosure.

These properties often present opportunities for investment and rehabilitation.

Research local foreclosure listings and attend auctions to find potential deals.

Offer Assistance to Homeowners

Investors can also offer assistance to homeowners facing foreclosure.

By negotiating purchase agreements or providing short-term financial aid, you can help homeowners while securing profitable investment opportunities.

Stay Informed on Local Laws

Staying informed about Cape Coral’s foreclosure laws and regulations is crucial for investors.

Understanding legal requirements and market trends will enable you to make strategic decisions and avoid potential pitfalls.

Building a Support Network

Building a support network is vital, as it provides access to vital resources, guidance, and emotional encouragement to navigate challenging financial situations in Cape Coral.

Engage with Community Resources

Cape Coral offers various community resources to help homeowners facing foreclosure.

Local nonprofits, legal aid organizations, and housing counselors can provide valuable support and guidance.

Join Support Groups

Support groups for homeowners facing foreclosure can offer emotional and practical assistance.

Sharing your experiences and knowing from others can help you navigate the challenges of foreclosure prevention.

Professional Assistance

Hiring professionals such as real estate agents, financial advisors, and attorneys can provide expert guidance and increase your chances of successfully preventing foreclosure.

Conclusion

Foreclosure is a challenging experience, but it’s important to remember that there are numerous prevention measures available in Cape Coral, Florida. By understanding foreclosure, exploring various prevention strategies, and seeking professional guidance, you can protect your home and financial future.

**NOTICE: Please note that the content presented in this post is intended solely for informational and educational purposes. It should not be construed as legal or financial advice or relied upon as a replacement for consultation with a qualified attorney or CPA. For specific guidance on legal or financial matters, readers are encouraged to seek professional assistance from an attorney, CPA, or other appropriate professional regarding the subject matter.