Facing foreclosure is a daunting experience for any homeowner, leaving many to wonder if they can ever reclaim their property. In the heart of this distress lies the question: can you get your house in Lehigh Acres back after foreclosure? Understanding foreclosure’s process and implications is crucial for navigating this challenging situation. Read on as we explore the options available and provide insights on how you can get your house in Lehigh Acres back after foreclosure, offering hope and guidance for your recovery journey.

Steve Daria and Joleigh, experienced real estate investors in Lehigh Acres, understand the complexities of foreclosure and the potential paths to recovery. They emphasize the importance of exploring all available options, including loan modifications, repayment plans, and even auctioning the property. With their expertise, homeowners can find helpful strategies to reclaim their homes and regain their financial footing.

Understanding Foreclosure and Its Impact

It is a legal procedure initiated by a lender to take back the balance of a loan that is in default by taking possession of the property and securing the mortgage.

When a homeowner does not succeed in making mortgage payments as agreed, the lender can move forward with foreclosure to recoup their financial losses.

If your house in Lehigh Acres has been foreclosed, this means the lender has legally taken ownership of your property, and you have lost your rights to it.

Foreclosure can severely harm your credit rating, making it difficult to get future loans or credit, and may also lead to other financial challenges such as increased debt or the loss of assets.

Foreclosure can lead to:

- Loss of homeownership

- Damage to credit history

- Emotional and psychological stress

Understanding these impacts is the first step in exploring whether you can get your house in Lehigh Acres back after foreclosure.

The Redemption Period – Your Window of Opportunity

The redemption period is a vital concept in foreclosure law.

It’s a specific timeframe during which homeowners have the right to reclaim their property by paying off their outstanding debt, including fees and interest.

In Florida, there is no statutory redemption period after a judicial foreclosure, but some mortgages may include a redemption clause.

Key points about the redemption period:

- Limited timeframe (often a few months)

- Full repayment required

- Legal fees and additional costs included

Right of Reinstatement – Another Path to Reclaim Your Home

Right of reinstatement allows homeowners to stop the foreclosure process by catching up on missed payments and covering any related costs before the foreclosure sale takes place.

This option is more accessible for those who have experienced temporary financial setbacks.

Steps to exercise the right of reinstatement:

- Assess the total amount owed, including missed payments, late fees, and legal costs.

- Contact your lender to express your intent to reinstate the mortgage.

- Gather the necessary funds and make the payment within the stipulated timeframe.

Get An Offer Today, Sell In A Matter Of Days…

Negotiate with Your Lender

Sometimes, direct negotiation with your lender can yield positive results.

Lenders may be willing to work with you to avoid the lengthy and costly foreclosure process.

Possible negotiation strategies:

- Loan modification

- Repayment plan

- Forbearance agreement

Open disclosures with your lender can lead to mutually beneficial solutions, making it easier to get your house in Lehigh Acres back after foreclosure.

Government Programs and Assistance

There are several government programs designed to help homeowners facing foreclosure.

These programs give financial assistance, counseling, and other resources to prevent foreclosure and assist in recovery.

Examples of government programs:

- Home Affordable Modification Program (HAMP)

- Making Home Affordable (MHA)

- Florida Hardest-Hit Fund (HHF)

Legal Options and Bankruptcy

Filing for bankruptcy can temporarily halt the foreclosure method, giving you time to reorganize your finances and explore other options.

However, this is a complex decision with long-term consequences.

Types of bankruptcy:

- Chapter 7 (liquidation)

- Chapter 13 (repayment scheme)

Talking with a bankruptcy lawyer can assist you identify if this is a viable option to get your house in Lehigh Acres back after foreclosure.

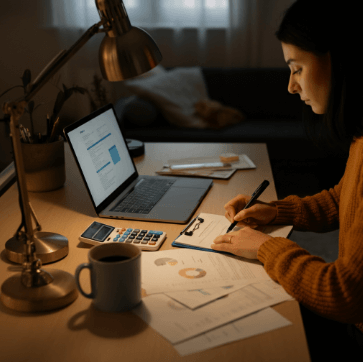

Tips for Preventing Foreclosure

Prevention is always better than cure. Here are some tips to avoid foreclosure in the first place:

- Contact your lender at the first indication of trouble

- Explore refinancing options

- Seek financial counseling

- Create a budget to manage your expenses

Being proactive can help you keep your home and avoid the distress of foreclosure.

Frequently Asked Questions

Explore the most common queries about getting your house back after foreclosure.

Can I buy my house back after foreclosure?

Yes, in some cases, it is possible to buy your house back after foreclosure, though the options applicable depend on the specific circumstances of the foreclosure process.

During the redemption period, which is a grace period that some states allow after foreclosure, you may have the opportunity to repay the full amount owed and reclaim your property.

Alternatively, you might be able to negotiate with the new owner or purchaser of the property to repurchase it, especially if they are open to offers or if the property has not yet been resold.

How does foreclosure affect my credit score?

Foreclosure can greatly damage your credit score, making it harder to get loans and credit in the future.

It’s essential to work on rebuilding your credit after foreclosure.

Are there any tax implications of foreclosure?

Yes, foreclosure can indeed have significant tax implications that you need to be aware of.

When a foreclosure occurs, any debt that is forgiven by the lender may be considered taxable income by the IRS.

This means that the amount of the forgiven debt could be added to your taxable income for the year, potentially increasing your tax liability.

Conclusion

Getting your house in Lehigh Acres back after foreclosure is challenging but not impossible. By understanding your rights, exploring various strategies, and looking for assistance, you can increase your chances of reclaiming your home.

Whether through the redemption period, right of reinstatement, negotiation, or legal options, there are multiple paths to recovery. Remember, each situation is unique, so it’s essential to evaluate your choices carefully and seek professional advice when needed.

**NOTICE: Please note that the content presented in this post is intended solely for informational and educational purposes. It should not be construed as legal or financial advice or relied upon as a replacement for consultation with a qualified attorney or CPA. For specific guidance on legal or financial matters, readers are encouraged to seek professional assistance from an attorney, CPA, or other appropriate professional regarding the subject matter.